Note: I ran into this formula on Jeff Lenning's blog over at Excel University. The effective tax rate in G7 is total tax divided by taxable income: =G5/inc // returns 13.7% The complete formula is solved like this: =VLOOKUP(inc,rates,3,1)+(inc-VLOOKUP(inc,rates,1,1))*VLOOKUP(inc,rates,2,1)Ĭell G6 contains the top marginal rate, calculated with VLOOKUP: =VLOOKUP(inc,rates,2,1) // returns 22% This is multiplied by the income calculated in the previous step. The second VLOOKUP calculates the remaining income to be taxed: (inc-VLOOKUP(inc,rates,1,1)) // returns 10,525įinally, the third VLOOKUP gets the (top) marginal tax rate: VLOOKUP(inc,rates,2,1) // returns 22% With a taxable income of $50,000, VLOOKUP, in approximate match mode, matches 39,475, and returns 4,543, the total tax up to $39,475. In G5, the first VLOOKUP is configured to retrieve the cumulative tax at the marginal rate with these inputs: For readability, the following named ranges, are defined: "inc" (G4) and "rates" (B5:D11). The formula in D6, copied down, is: =((B6-B5)*C5)+D5Īt each row, this formula applies the rate from the row above to the income in that bracket.ģ. In order for VLOOKUP to retrieve the actual cumulative tax amounts, these have been added to the table as a helper column in column D. In the event of an exact match, VLOOKUP will return results from the matched row.Ģ. Then it will "step back" and return a value from the previous row. When in approximate match mode, VLOOKUP will scan through lookup values in a table (which must be sorted in ascending order) until a higher value is found. This formula depends on VLOOKUP function in "approximate match mode". (displayed as 6,859 in the example shown).

#Ca tax brackets calculator manual

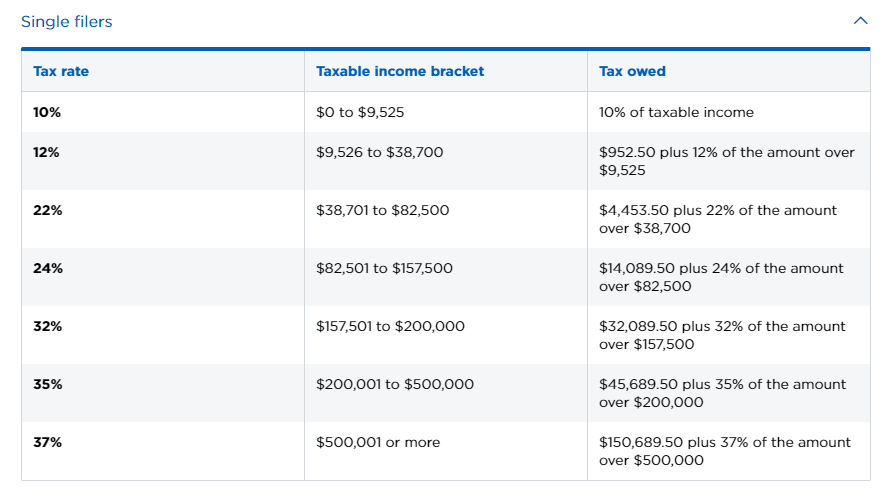

The table below shows the manual calculations for a taxable income of $50,000: Bracket In the example shown, the tax brackets and rates are for single filers in the United States for the 2019 tax year. Many taxpayers therefore pay several different rates. As taxable income increases, income is taxed over more tax brackets. The amount of income that falls into a given bracket is taxed at the corresponding rate for that bracket. Rates are assessed in brackets defined by an upper and lower threshold. The US Tax system is "progressive", which means people with higher taxable income pay a higher federal tax rate. Where "inc" (G4) and "rates" (B5:D11) are named ranges, and column D is a helper column that calculates total accumulated tax at each bracket. The formula in G5 is: =VLOOKUP(inc,rates,3,1)+(inc-VLOOKUP(inc,rates,1,1))*VLOOKUP(inc,rates,2,1) To calculate total income tax based on multiple tax brackets, you can use VLOOKUP and a rate table structured as shown in the example.

0 kommentar(er)

0 kommentar(er)